Tile Industry Enters New High-Quality Development Stage, Green Intelligence and Technological Innovation Become Key to Breaking Through

In recent years, driven by tightening environmental policies, upgraded consumer demands, and the restructuring of the international trade landscape, China’s tile industry is undergoing a profound transformation from “scale expansion” to “value重塑.” Breakthroughs in green manufacturing, product innovation, and market diversification demonstrate the industry’s resilience and vitality. 1. Industry Status and Market Scale: Structural Optimization and Quality Improvement The global tile market continues to grow, with industry reports indicating that the global ceramic market size reached approximately $438 billion in 2023 and is expected to exceed $580 billion by 2028, with a compound annual growth rate of 5.8%-1. As the world’s largest tile producer and consumer, China is accelerating the optimization of its production capacity structure. In 2024, the national architectural ceramic output fell to 5.91 billion square meters, but the proportion of high-end products increased significantly. Among them, the share of slabs and large-format tiles jumped from 28% to 45%, while traditional glazed tile capacity shrank by 30%-1. This shift reflects the industry’s transition from “competing on quantity” to “improving both quality and efficiency.” Regionally, East and South China contribute over 65% of the national effective supply, with intelligent transformation reducing leading enterprises’ production costs by 18%-22%-1. Meanwhile, industry concentration further increased, with the number of large-scale building ceramic enterprises dropping to 993 in 2024, a decrease of over 400 from previous statistics-6, indicating accelerated elimination of low-end capacity and resource concentration toward technologically advanced firms. 2. Technological Innovation Drives Product Upgrades: Advancements in Materials Science and Processes 1. Material and Structural Innovations The recently launched “double pre-stressed toughened white-body ceramic tile,” featuring a sandwich structure of surface compressive stress, a middle buffer layer, and a bottom support layer, addresses the traditional trade-off between strength and toughness, achieving internationally leading technological standards-7. This technology significantly enhances impact resistance without substantially increasing costs, broadening tile applications in high-end engineering and home renovation scenarios. Concurrently, “double-zero low-water-absorption tiles” have entered mass production, with water absorption rates approaching zero and breaking strength and modulus of rupture far exceeding national standards-10. By utilizing solid waste such as bluestone tailings and industrial slag, related enterprises achieve a resource utilization rate exceeding 30% and reduce energy consumption by over 20%, highlighting the synergy between green manufacturing and high performance-10. 2. Process and Functional Innovations In terms of processes, digital inkjet printing, 3D printing, and granular glaze technologies are widely adopted, advancing products from “form similarity” to “texture authenticity.” For example, “composite granular glitter-effect glossy ceramic tiles” combine special granules and glaze processes to achieve three-dimensional sparkling effects while ensuring stain resistance-2. Functional tiles are also rapidly emerging, with products featuring antibacterial, anti-slip, and self-cleaning properties reaching a market penetration rate of 47%-1. Photocatalytic self-cleaning technology enhances visible light utilization efficiency through material modification, offering new options for green buildings; graphene heating tiles gain popularity in northern markets due to their energy-saving features-1. 3. Product Design and Consumer Trends: Integration of Durability and Aesthetics Consumer upgrades drive demand differentiation. Research shows that 85.66% of consumers prioritize quality as the primary purchasing factor, with over 80% paying attention to wear and stain resistance. New-generation durability technologies, such as nano-diamond glazes and microcrystalline composite layers, enable tiles to achieve a Mohs hardness of 6-8, increasing wear resistance by over 30% compared to ordinary glazes-6. In aesthetic design, warm tones have become mainstream globally, with the proportion of soft colors like beige and ivory white increasing-5. Small-format tiles (e.g., 20×20mm, 75×30mm) are regaining popularity, enhancing spatial storytelling through color and 3D pattern combinations-5. Categories like wood-grain and cement-effect tiles meet personalized demands through color innovation and texture upgrades. Wood-grain tiles, with their warm texture and detailed refinements, represent the “quiet luxury” trend-5. 4. Sustainable Development and Green Transformation: Policy and Technology Synergy Driven by dual-carbon goals, the industry’s green transition is accelerating. In energy structure, natural gas accounts for 58% of ceramic tile production, rising to 95% in sanitary and specialty ceramics-1. Electric kiln applications expand, with firing temperature control precision errors within ±3 degrees Celsius, increasing product qualification rates to 94%-1. Low-carbon technologies achieve milestone breakthroughs. The world’s first ceramic industry ammonia-hydrogen zero-carbon combustion demonstration line produces 1.5 million square meters annually, directly achieving zero carbon emissions during combustion-1. If adopted in major production areas, annual carbon reduction could reach 665,000 tons. In solid waste recycling, waste ceramic 100% recovery technology helps selected enterprises reduce raw material costs by over 20%-1. Policy-wise, the Ministry of Industry and Information Technology requires an additional 8% reduction in energy consumption per unit product by 2025-9, while green building material certification coverage reaches 52%, and the mandatory proportion of energy-saving products in government procurement catalogs increases to 30%-1. These dual mechanisms propel the industry toward cleaner production. International Trade Environment and Global Strategy: Seeking Opportunities in Barriers, Diversifying Layouts The international trade environment is becoming increasingly complex. The U.S. anti-subsidy duty rate on Chinese tiles reaches 358.81%, almost blocking direct export routes-3. Anti-dumping investigations by Vietnam, India, and others add external market pressure-3. Facing these challenges, Chinese enterprises break through via technological upgrades and market diversification. High-value-added products like electronic ceramics and new energy ceramic separators see export growth of 35%-1; categories such as slabs and intelligent temperature-adjusting tiles account for over 30% of global production capacity-3. In market strategy, Belt and Road Initiative and RCEP member countries become new growth points, with the proportion of non-U.S. exports rising to 65% in 2024-3-8. Strong real estate demand in Southeast Asia and the Middle East attracts numerous companies to establish overseas production bases, increasing capacity by up to 30%-1. 6. Future Prospects: Innovation and Collaboration Leading the Industry into a New Era The industry will focus on three key directions: Deep Technology Integration: Ceramic 3D printing, AI quality inspection, and zero-carbon combustion technologies are gradually industrializing. The ceramic 3D printing market is projected to reach $2.5 billion by 2034, with a CAGR exceeding 31%-1. Value Chain Enhancement: Transition from single product output to “product + service” system solutions, such as seamless installation and space customization services, enhancing user loyalty-4. Globalization 2.0: Building differentiated competitiveness through overseas localized production and cross-border collaborations (e.g., tile partnerships with furniture and design brands). In summary, powered by greening, intelligence, and high-end development, China’s tile industry is navigating through cyclical challenges toward a high-quality growth journey. Guided by policies, driven by innovation, and fueled by consumer upgrades, the industry is poised to reshape the global competitive landscape, transitioning from a “manufacturing giant” to a “quality manufacturing powerhouse.”

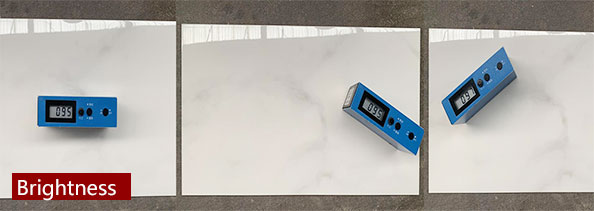

Water absorption : 16%

Finish : Glossy

Application : Wall

Technical : Rectified

| Size (mm) | Thickness (mm) | Packing Details | Departure Port | |||

| Pcs/ctn | Sqm/ ctn | Kgs/ ctn | Ctns/ Pallet | |||

We take Quality as our blood, the efforts we poured on the product development must match with strict quality control.

Service is the basic of long lasting development, we hold fast to the service concept: quick response, 100% satisfaction!